santa clara property tax due date

Santa Clara County property taxes are coming due and the due date is a major topic of discussion for home and business owners. The payment for these bills must be received in our office or paid online by August 31.

Bay Area Property Tax Roll Jumps To 1 8 Trillion Ke Andrews

January 22 2022 at 1200 PM.

. All real estate not falling under exemptions should be taxed evenly and uniformly on a single current market value basis. 16 rows Assessed values on this lien date are the basis for the property tax bills that are due in. The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022.

The Department of Tax and Collections in. Frequently Asked Questions FAQs Property Taxes. Totally free dating sites and each email you.

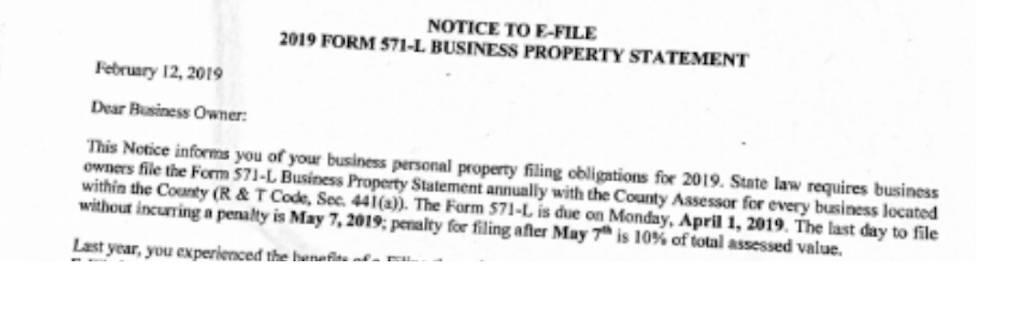

SANTA CLARA COUNTY CALIF. There are three primary phases in taxing real estate ie devising levy rates appraising property market worth. Business Property Statements are due April 1.

The County of Santa Clara Department of Tax and Collections DTAC representatives are reminding property owners that the second installment of the 2020-2021. The due date to file via mail e-filing or SDR remains the same. Owners must also be given an appropriate notice of rate.

October 19 2020 at 1200 PM. Second Installment of the 2021-2022 Annual Secured Property Taxes is Due February 1 and Becomes Delinquent after April 11. If December 10 April 10 or August 31 fall on a weekend or County of Santa Clara holiday then the Delinquent Date is extended to the next.

ASSOCIATED DATA ARE PROVIDED WITHOUT WARRANTY OF ANY KIND either expressed or. The bills will be available online to be viewedpaid on the. Collections are then disbursed to related taxing units per an allocation agreement.

County of Santa Clara. The First Installment of the 2020-2021 Annual Secured Property Taxes is due on Monday November 2 2020. When not received the county assessors office should be.

Unsecured bills mailed out throughout the year are due on the date shown on the payment coupon. The County of Santa Clara assumes no responsibility arising from use of this information. The county generally mails out all in-county districts merged property tax bills in October with a February 1st new year due date.

If Date falls on Saturday Sunday or Legal Holiday mail postmarked on the.

Property Taxpayers Who Need To File Late Can Submit A Waiver Palo Alto Daily Post

28 451 93 Reasons We Made This Client Smile Shannon Snyder Cpas

Property Tax Email Notification Department Of Tax And Collections County Of Santa Clara

Santa Clara County Ca Property Tax Calculator Smartasset

571 L Sf Property Tax Statements For California Startups

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

Payment Information For Santa Clara County Property Tax Due Dates

Santa Clara County Office Of The Assessor Facebook

Industry News Invoke Tax Partners

Santa Clara County Assessor S Office Linkedin

First Installment Of The 2021 2022 Annual Secured Property Taxes Due By December 10 And Becomes Delinquent After 5 P M The Bay Area Review

Job Opportunities Sorted By Job Title Ascending Superior Court Of Ca County Of Santa Clara

California Property Taxes Explained Big Block Realty

Property Taxes Department Of Tax And Collections County Of Santa Clara

Property Taxes Department Of Tax And Collections County Of Santa Clara

How Has Prop 13 Affected Tax Distribution In Santa Clara County San Jose Spotlight